G&A expenses are the day-to-day costs that a business must pay to operate, regardless of manufacturing or generating income.

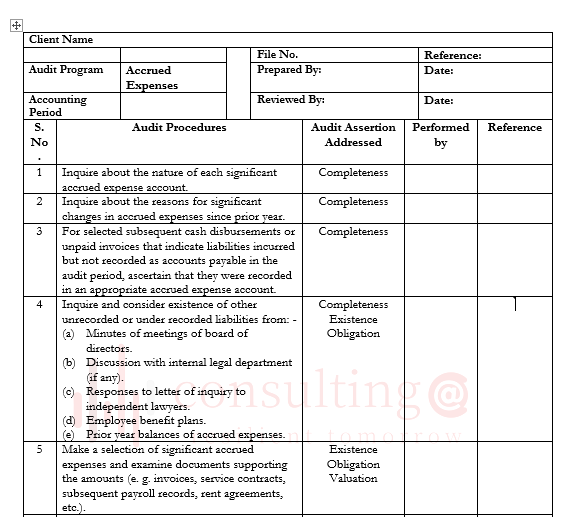

An expense audit is required to be completed by testing several claims such as cut-off, completeness, accuracy, and occurrence. Auditors should review firm expenditures to ensure that they were both required and consistent with the organization’s internal policies. The auditor will need to gather enough appropriate audit evidence, and the audit technique will differ based on the client’s business. Depending on the level of risk involved in the targeted transactions, the auditors will establish audit processes.

Reviews

There are no reviews yet.