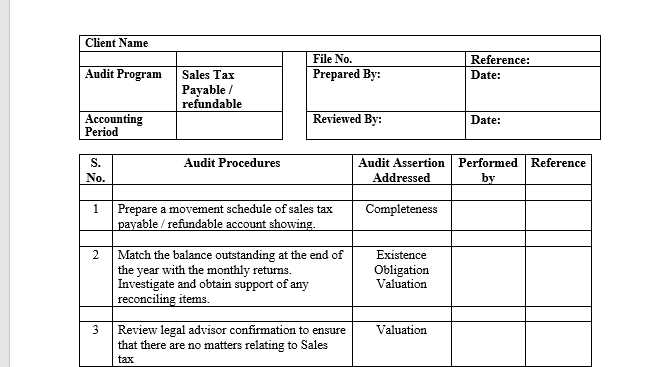

Sales taxes payable is a liability account in which is stored the aggregate amount of sales taxes that a business has collected from customers on behalf of a governing tax authority. The business is the custodian of these funds and is liable for remitting them to the government on a timely basis. If the organization remits large amounts of sales taxes, the government probably requires sales taxes payable to be remitted once a month. If the amount paid is quite small, some governments allow the funds to be remitted at much longer intervals, such as once a quarter or once a year.

The sales taxes payable account is always considered to be a short-term liability since (as just noted) the funds are always to be remitted within one year. Typically, the account is combined with the balance in the accounts payable account and presented in the balance sheet within the accounts payable line item.

A government entity may send its auditors to a business at intervals to examine the method of calculating sales taxes, and also to examine the contents of the sales taxes payable account. If the company has not been calculating or remitting sales taxes correctly, the auditors can charge the company a penalty and other fees.

Reviews

There are no reviews yet.