Deferred tax liability is a listing on a company’s balance sheet that records taxes owed but are not due to be paid until a future date. For instance, retirement savers with traditional 401(k) plans contribute to their accounts using pre-tax income. When that money is eventually withdrawn, income tax is due on those contributions. That is a deferred tax liability.

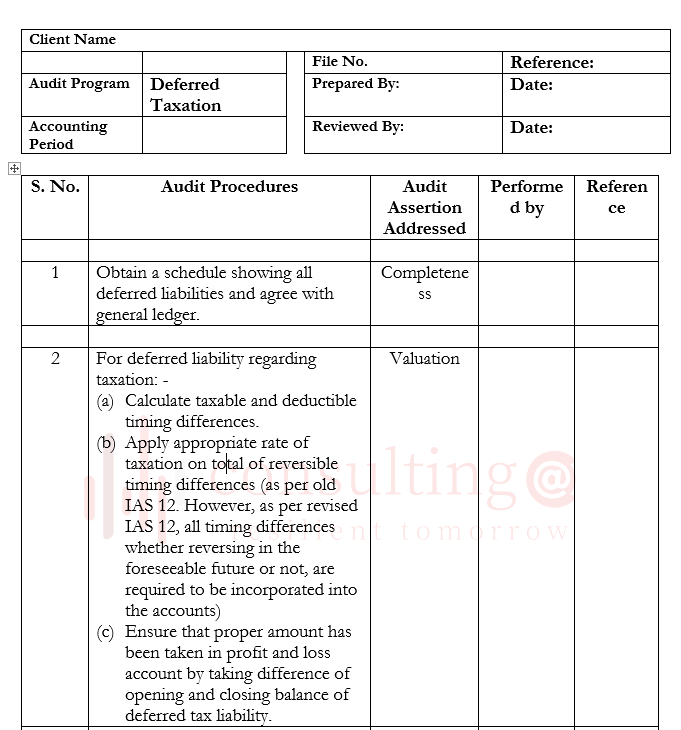

Deferred Taxation

1566EGP

Reviews (0)

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.