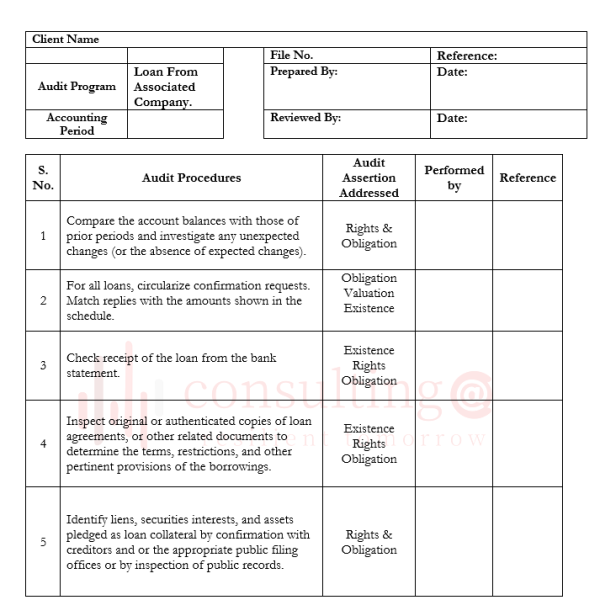

As loans between limited companies are allowed, however, the loan is only allowed if the company making the loan has sufficient funds to cover any liabilities that may arise during the period that the money is outstanding.

The draw for many companies to loan money to another limited company is that the rate of interest applied is much lower than that of a bank loan.

The loan is not treated as a business expense; therefore, it does not reduce your Corporation Tax liability. The money you earn from the interest on the loan is classed as income and will be taxable.

Loans and are a significant part of other assets in the financial statements, especially for group companies, and sufficient testing procedures are required to perform by auditors.

Reviews

There are no reviews yet.