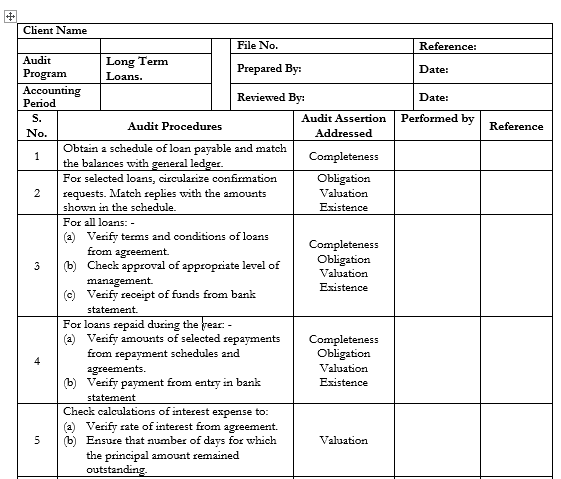

- Companies, like individuals, have long-term loans. To perform an audit, you need to understand the forms a company’s long-term loans can take and the debt-related issues you need to consider when conducting your audit. Your audit clients use three debt vehicles: mortgages, notes, and bonds, to finance the acquisition of their assets. Depending on the client, bonds may not be as common as mortgages and notes.

- Mortgages are used to finance the purchase of real property tangible assets. The property collateralizes the mortgage, which means the property is held as security on the mortgage.

- Notes are formal written documents that spell out how money is being borrowed. This type of agreement between a lender and a borrower specifies principal, rate, and time.

- Bonds are long-term lending agreements between a borrower and lender.

Previous product

Back to products

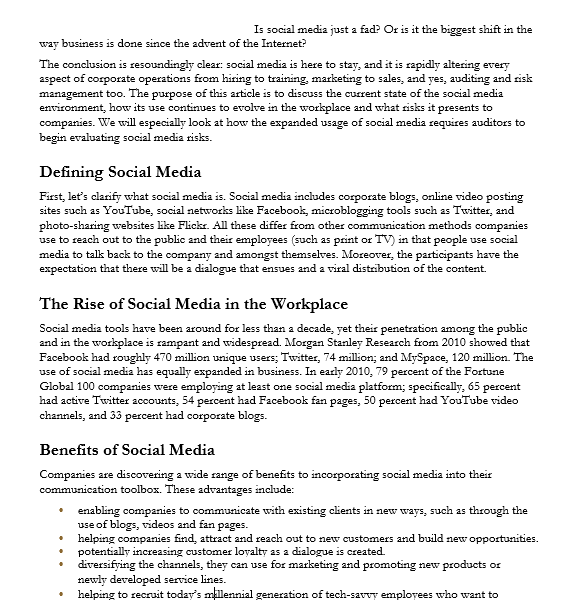

Managing Risk In Social Media

41320EGP 31320EGP

Long Term Loans

1566EGP

Description

Reviews (0)

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.