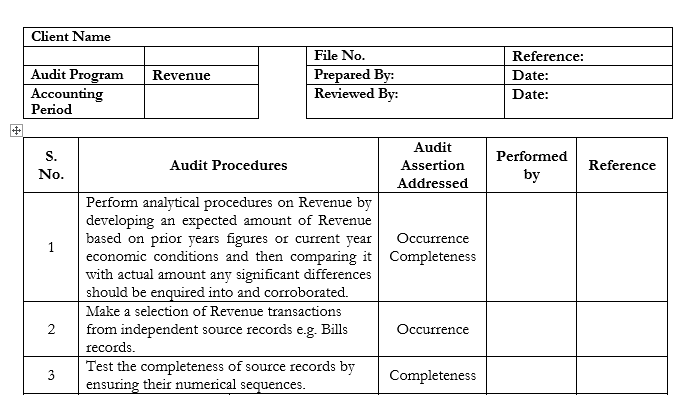

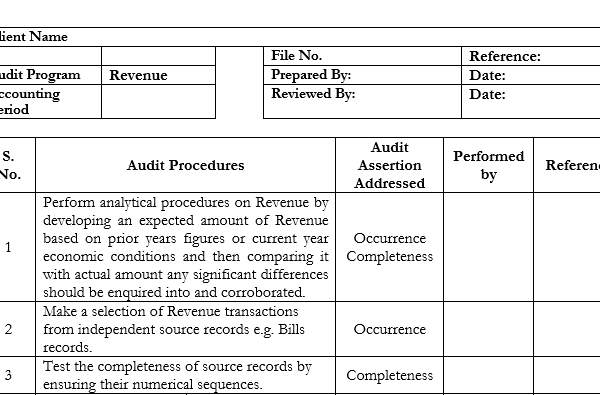

A revenue audit is a two-part process that examines the figures and information on a company’s tax returns against those found in its business records. In general, auditors check the returns of income over a one-year period. However, they may review your records for prior years too in case they notice any discrepancies.

This process has the role to monitor and ensure tax compliance. It also helps identify signs of tax evasion as well as additional liabilities. The auditors will also collect interest, tax, or penalties where applicable.

Reviews

There are no reviews yet.