- Selling costs such as wages, commissions, and out-of-pocket which consider as indirect expenses on a company’s income statement because they don’t supply directly to the making of a product or service.

- Distribution costs are the costs incurred to deliver the product from the production unit to the end user The cost of moving the product from the place of production to the pick-up point is also included in the distribution cost.

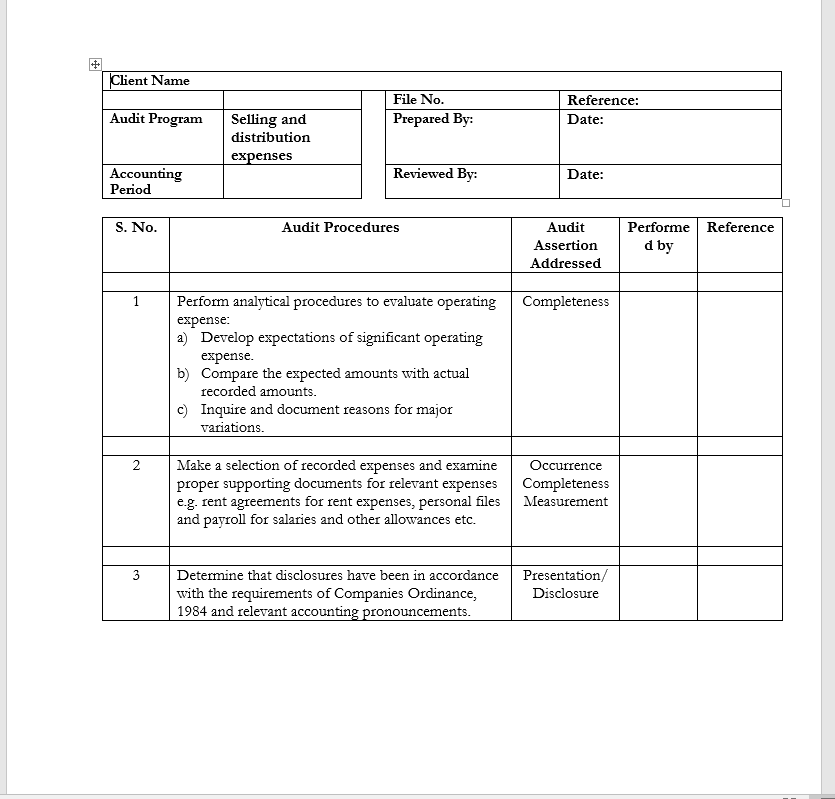

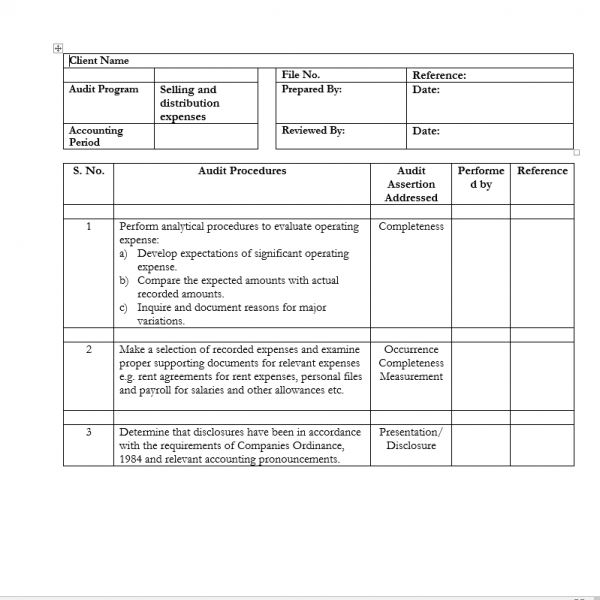

- Selling and distribution expenses form is one of the Audit programs.

- This document offers a specific form for Selling and distribution expenses includes Audit procedures, Audit Assertion Addressed, by who this was performed, and the reference.

Selling and distribution expenses

1566EGP

Description

Reviews (0)

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.