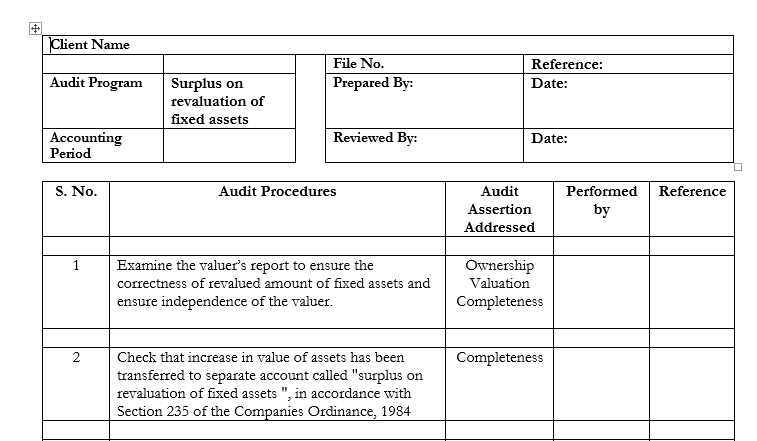

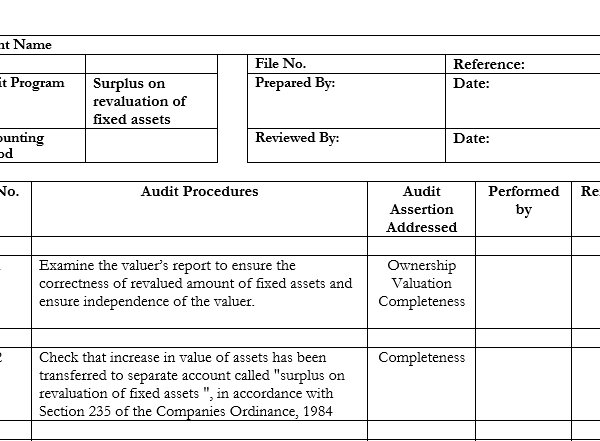

A revaluation surplus is an equity account in which any increases in the value of capital assets are recorded. If a revalued asset is later dispositioned from a firm, any residual revaluation excess is credited to the entity’s retained profits account.

A rise in the asset’s value should not be recorded on the income statement; instead, it should be credited to an equity account named “Revaluation Surplus.” The revaluation surplus is recorded in the balance sheet’s other comprehensive income sub-part of the owner’s equity section.

Reviews

There are no reviews yet.