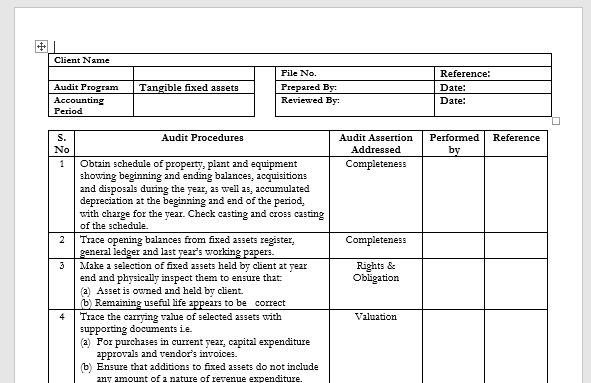

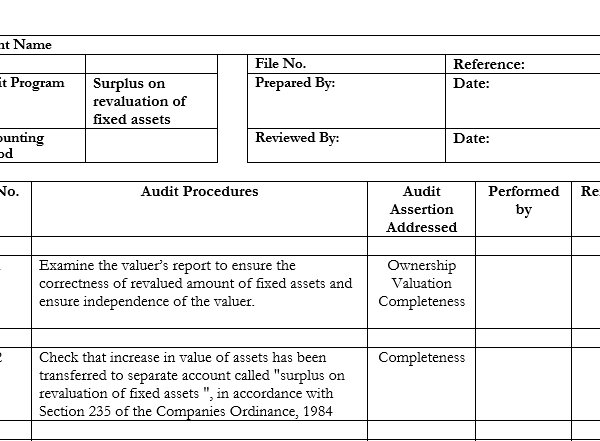

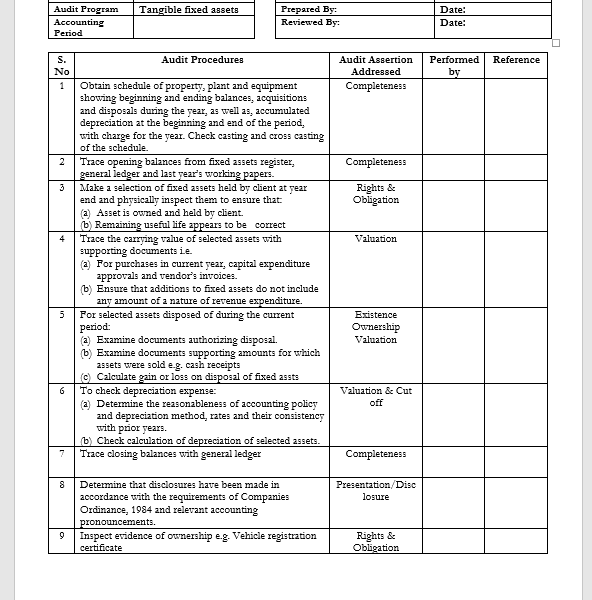

Assets with a physical value are referred to as tangible fixed assets. Your business premises, equipment, inventory, and machinery are examples of this. Tangible fixed assets have a market value that needs to be accounted for when filing your annual accounts. Some of these assets, for example, computer equipment, will incur depreciation, which needs to be factored into your accounts.

Tangible Fixed Assets

1566EGP

Reviews (0)

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.