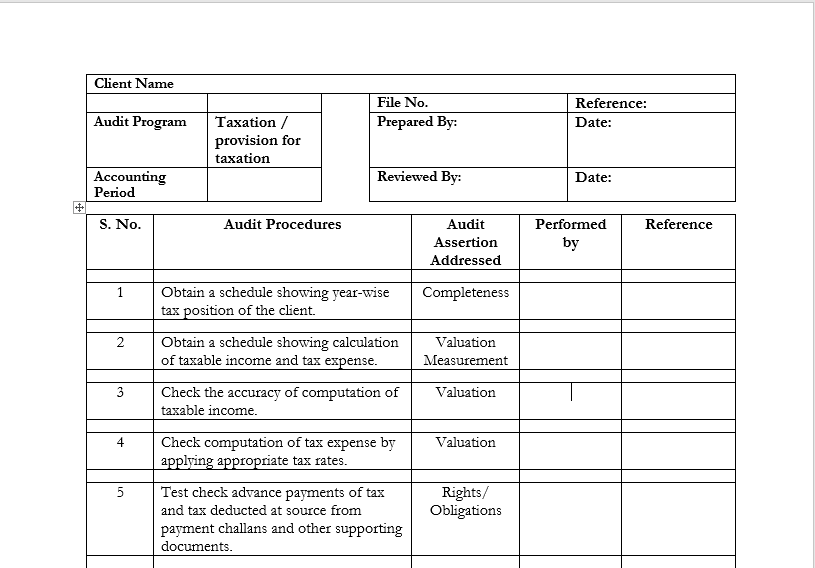

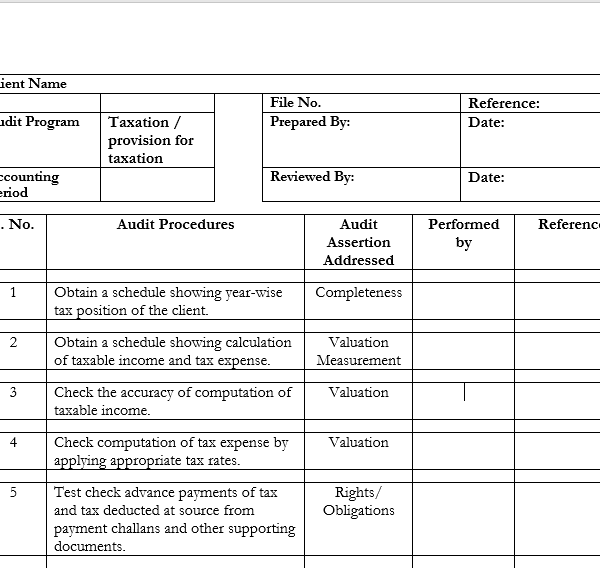

The provision for taxation is the amount set aside from current profits to cover the tax obligation. There is a time lag between making the provision and paying the actual tax liability. As a result, it acts as a source of short-term funding throughout the intermediate period.

Profit is the driving force for this policy. Taxable income is calculated after deducting essential things from gross profit (for example, depreciation recorded in books of accounts and depreciation permissible under income tax laws). On that taxable profit, we should make an allowance for income tax at the applicable rate.

Reviews

There are no reviews yet.