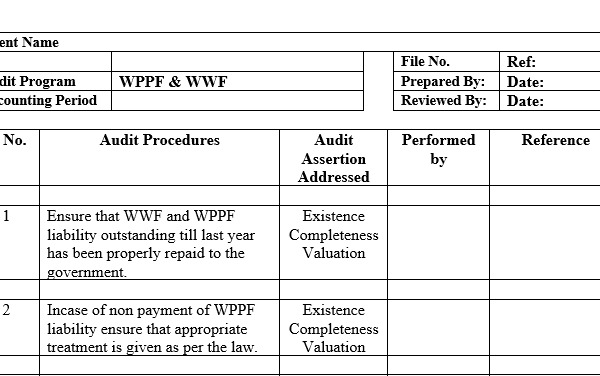

-According to Worker’s Welfare Fund Ordinance, 1971, every industrial establishment shall contribute to Worker’s Welfare Fund an amount equal to two percent (2%) of total income provided that total income for that year is not less than 5 lac rupees (500,000).

– According to the Companies Profits (Workers’ Participation) Act, 1968, every company is required to pay five percent (5%) of its profits to Worker’s Participation Fund every year. However, there was some confusion about whether such an amount should be calculated before charging such WPPF or after WPPF.

Reviews

There are no reviews yet.